The DuPont Model, also known as DuPont Analysis, is a financial analysis technique that breaks down a company’s return on equity (ROE) into three key components:

PROFITABILITY, EFFICIENCY, and LEVERAGE. It was introduced by the DuPont corporation in the 1920s and has been widely used ever since.

Its main purpose is to identify a company’s strengths and weaknesses by analyzing the efficiency with which it is using its resources.

It allows us to understand how a company is generating its profitability and what factors influence it. It is a vital tool for any financial analyst or investor.

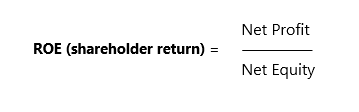

Financial Profitability ROE:

Financial profitability, also known as ROE (Return on Equity), is a financial indicator that measures a company’s ability to generate net profit from its own resources or equity.

A high ROE indicates that the company is generating a good return on the capital invested by shareholders. However, it is important to compare a company’s ROE with that of other companies in the same sector to get a more accurate idea of its relative performance.

How is ROE calculated?

ROE is calculated by dividing a company’s net profit by its net equity (or equity) expressed as a percentage.

For example; if we obtain an ROE of 9.3%, what does this tell us? That for every 100 euros invested in the company, we obtain a return of 9.3 euros of profit.

It is advised that the ROE be between values greater than 10%.

Once we have calculated the financial return, HOW CAN WE KNOW WHY OTHER INDUSTRIES HAVE HIGHER OR LOWER ROE? To understand why it has increased or decreased, the DuPont Framework analysis is useful.

DUPONT FRAMEWORK

Components of the DuPont Model:

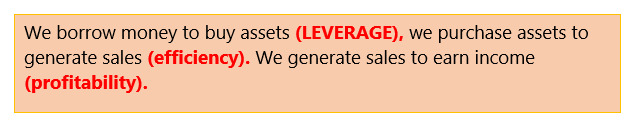

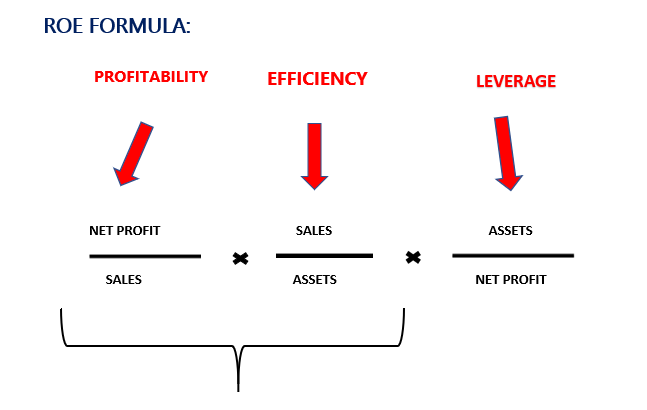

The DuPont Framework divides the ROE into three fundamental factors:

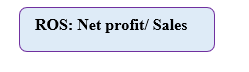

Profitability ROS: This component analyzes how much net profit the company generates for each unit of sale. It is the percentage of sales left after deducting all expenses.

Total asset turnover: how many sales a company generates for each euro invested in its assets, that is, how efficiently the company uses its assets to generate sales.

Financial leverage: The amount of debt a company uses relative to its own capital. That is, how much money has been borrowed to buy assets.

PROFITABILITY / RETURN ON SALES (ROS)

The ROS indicates HOW MANY EUROS of profit we generate for each sale.

It refers to the efficiency with which a company converts its income into profits. It is an indicator of how well a company is managing its costs and operating expenses.

Example:

If your company sold products for 100,000 euros and obtained 15,000 euros of net profit, your ROS is 15%.

This means that for every 1 euro in sales, your company obtains 0.15 euros of profit.

A GOOD ROS is generally between 10% and 15%. It is crucial to know what part of the sales turns into profit.

EFFICIENCY ASSET TURNOVER:

The sales we can generate for each euro of assets. It helps to understand how effectively a company uses its assets to generate sales.

It considers how much you can maximize sales with the assets you own.

If, for example, you have total assets of 200,000 euros and your annual sales volume is 400,000 euros, your asset turnover is 2. That is, for every euro invested in assets, you got 2 euros in sales.

It measures how much we can maximize sales with the assets we have.

Strong control of working capital NOF is key to reducing the denominator and therefore increasing the efficiency ratio.

If it is low, it may be because the assets are high or the sales low. Compare it with other companies.

LEVERAGE:

Financial leverage measures how a company finances its operations, either through debt or equity.

It indicates the financial risk of the company and its ability to meet its financial obligations. That is, how much money has been borrowed to buy assets.

Example

If for every euro contributed by the owners there are 2.5 euros in assets, it means that the difference (1.5 euros) has been financed through debt or commitments with third parties.

ROE is broken down into: ROS X ASSET TURNOVER and this forms the ROA (return on assets) multiplied by the leverage.

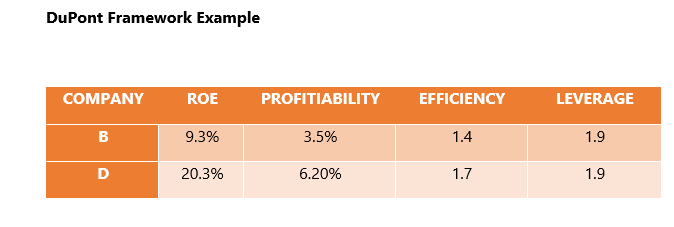

DuPont Framework Example

Company D has a higher ROE of 20.3% compared to 9.3% for Company B.

If we observe, we see that Companies B and D have the same level of debt, so the difference cannot be attributed to debt.

However, if we look at the degree of efficiency, we see how Company D generates 1.7 in sales for every euro of assets it has. That is, Company D is more efficient.

Now, looking at their profitability, we see that Company B is generating 3.5 euros of profit for every 100 euros invested, whereas Company D generates 6.20 euros.

In conclusion, Company D is much more efficient in generating sales with assets and generating profits with sales.

Conclusion:

The DuPont Analysis provides a deep insight into the financial and operational health of a company. By breaking down the ROE into these three key areas, the DuPont Model offers a much more detailed view of a company’s profitability than simply looking at the ROE alone.

It gives us an overview of how a company generates value and, furthermore, allows us to compare it with other companies, giving us a clear vision of its competitive advantage. If at any time you feel you need an expert hand to analyze the financial situation of your business, I am here to help. Your financial success is my mission.