What is the Break-Even Point?

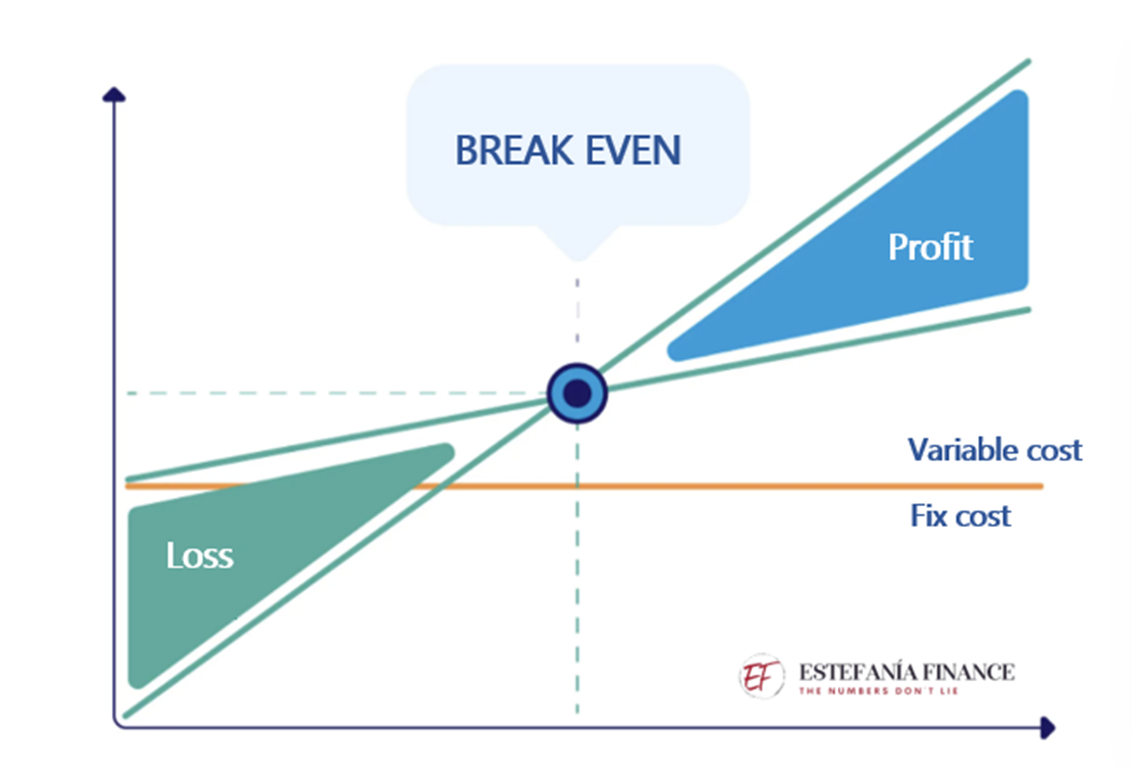

The break-even point is the level of sales at which a company’s total revenues equal its total costs. In other words, it’s the moment when a company neither makes nor loses money: it simply balances out.

Therefore, it’s essential for companies to calculate this break-even point, otherwise, the company would assume a high risk by not knowing how many units it needs to sell to cover its costs.

HOW MANY UNITS MUST I SELL TO MAKE A PROFIT?

During the development or operation of our businesses, we assume certain fixed and variable costs, but do we really know how many units we need to sell to cover all the costs?

✅ How many units must I sell to generate profits?

✅ How much total revenue do I need to cover costs?

✅ What is the maximum level of fixed costs I can assume?

✅ How much must I bill to achieve the desired profit?

✅ What is the maximum salary we can offer to an employee?

✅ How much financing can we ask for?

CALCULATION OF THE BREAK-EVEN POINT OR DEAD POINT.

To calculate the break-even point, the main thing is that you know what your fixed and variable expenses are and the contribution margin; that is, the difference between the volume of sales and the variable costs.

Fixed costs: do not change each month, they are the same regardless of the level of sales we have. Light, rent, salaries, insurance, depreciation…

Variable expenses: is the cost of materials, sales commissions, that is, those that increase as the units sold increase.

Contribution margin: Sale price – unit variable cost.

HOW IS THE BREAK-EVEN POINT CALCULATED?

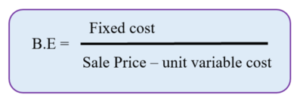

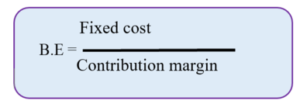

The basic formula for the Break-Even Point in physical units is:

It’s the same as saying:

break-even point = fixed costs / contribution margin

Contribution margin = sale price – unit variable cost

➤ Example:

Let’s assume you have a small store that sells shoes at €50 per pair.

The fixed costs (rent, wages, services) add up to €1200 per month, and the variable costs (materials, production) are €20 per pair.

Using the formula, we would have:

B.E.= €1200 / (€50−€20) =40 Pairs

This means you need to sell 40 pairs of shoes a month just to cover your costs. Any sale above this figure is a profit.

We see that if for example, we put a lower price of 30 euros per pair, our break-even point would now be higher:

B.E.= €1200 / (€30−€20) = 120 shoes

That is, the LOWER the price, the GREATER is the number of shoes we must sell to cover costs.

HOW MUCH DO WE HAVE TO SELL IN MONETARY UNITS (€, $, £)?

All we have to do is multiply the price of each unit by the break-even point:

Required sales: Break-Even Point (units) × Sale Price

In our example: 120 shoes x 50 euros/shoe = 2000€

The company should invoice 2000 euros per month to cover costs.

Or using the formula:

B.E. = Fixed costs / (1 – cost of sale / sale price)

Fixed costs: €1200

C.V: €20

Sale price: €50

B.E. = 1200 / (1 – 20/50)

B.E.= 1200 / (1-0.4) = €2000

« Variable costs, revenues, fixed costs could increase or decrease in the business, therefore, it is important that we calculate the break-even point monthly »

BENEFITS OF CALCULATING THE BREAK-EVEN POINT:

Make decisions: since knowing how much we must invoice to cover our costs we can focus on establishing sales objectives, reducing costs, we can also visualize the growth of the company over time.

Allows you to evaluate profitability: with the break-even point we can know if a business idea will be viable in financial terms or if our company is generating profits with the current level of sales.

Contingency plan: allows you to create a plan in case your business has seasons of seasonality, allowing you, for example, to maintain a larger treasury for possible liquidity problems in times of lower income.

BREAK-EVEN POINT ANALYSIS:

- If sales are equal to the break-even point, that is, we sell the same units. The company at that point has neither profits nor losses, it is said to be in financial equilibrium.

- If sales are higher than the break-even point, the company covers its costs and also makes a profit, it is in a profitability situation.

- If sales are lower than the break-even point, the company is making losses. That is, it is not profitable.

HOW CAN WE IMPROVE OUR BREAK-EVEN POINT?

- Offer fewer discounts to customers.

- Raise prices.

- Increase product differentiation.

- Negotiate prices with suppliers.

- Marketing strategies to make your product known.

- Outsource or subcontract all the processes you can.

- Eliminate unnecessary expenses.

- Sell or reduce unnecessary fixed costs.