Discover how to calculate this financial ratio and its importance for your company.

A company’s solvency is determined by whether it has sufficient resources (such as money and assets) to cover its long-term debts and obligations. In a nutshell, it answers the question:

Can this company survive in the long term?

The solvency ratio is an indicator used to determine a company’s financial health. Discover how it is calculated and its great utility within your business.

WHAT IS THE SOLVENCY RATIO AND HOW IS IT CALCULATED?

The solvency ratio reflects the company’s ability to meet its payment obligations. In other words, it indicates whether the company may have financial problems.

This ratio helps us understand the proportion of a company’s assets that are financed by its debts. A higher ratio means the company is more financially stable and less dependent on debts.

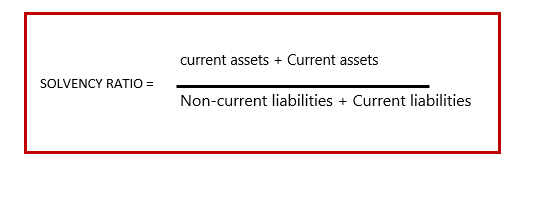

To calculate our solvency ratio, we need to divide the total value of our assets by the total value of our liabilities, excluding Equity from the operation.

For example, a solvency ratio of 1.5 means that the company has assets worth €150 for every €100 of debt.

WHAT SOLVENCY RATIO IS BEST?

Solvency ratio = Assets / Liabilities

The Importance of a Solvency Ratio Greater Than 1:

A solvency ratio greater than 1 indicates that a company’s assets exceed its liabilities, indicating financial stability. However, an excessively high ratio could also mean that the company is not effectively leveraging debt to finance growth, which would be generating idle resources.

In summary, we can say that:

? If the solvency ratio is less than 1 → the company CANNOT meet its payment obligations.

? If the solvency ratio is equal to 1.5: → The company could cover all its debts.

? If the solvency ratio is above 2 → We may risk accumulating cash losing value without generating any return.

It is advisable to have at least 2, which is what banks usually require to lend you money.

DIFFERENCE BETWEEN SOLVENCY AND LIQUIDITY.

Do not confuse solvency with liquidity.

Liquidity is the ability to generate cash, while solvency can be achieved with liquid or illiquid assets.

Although both solvency and liquidity ratios are used to assess a company’s financial health, they serve different purposes.

The liquidity ratio focuses on a company’s ability to cover short-term obligations. It’s the cash available to cover immediate payments.

On the other hand, the solvency ratio assesses a company’s ability to sustain itself in the long term.

That is, the solvency ratio evaluates a company’s total resources, taking into account both long-term and short-term obligations, while the liquidity ratio focuses on the most cash-convertible resources, such as cash and market instruments, analyzing their ability to meet imminent financial commitments in the short term.

SOLVENCY IS THE ABILITY TO MEET LONG-TERM PAYMENTS.

Both are necessary for the survival of the company. The company must generate goods to cover all its debts, but it must also generate liquid assets to meet current obligations.

We must take care of long-term solvency and liquidity.

HOW CAN WE IMPROVE THE SOLVENCY RATIO?

Improving the solvency ratio can be achieved by increasing the value of net equity or by reducing the value of liabilities.

- Increase own capital: by issuing new shares to obtain more capital from shareholders.

- Accumulate capital from positive exercises and not distribute them as dividends is the healthiest way to improve the solvency ratio.

- Reduce indebtedness: Paying off existing debts, especially those with high interests, can improve solvency. This may involve restructuring existing debt to get better terms or consolidating several debts into one with a lower interest rate.

- Optimize assets: Identifying and disposing of non-productive or underutilized assets can provide additional liquidity to reduce debts. It is also important to invest in assets that generate stable and predictable cash flows.

Another solvency measure to consider is the debt/equity ratio:

TOTAL LIABILITIES / EQUITY

This is an indicator that measures the degree of indebtedness of a company in relation to its own funds (or equity).

Interpretation

A result greater than 1 indicates that the company has more debts (total liabilities) than equity. This can be a sign of high financial risk, as it means that the company is highly leveraged.